consequently, greater saving contributes to much more expense fueled by that saving, much of it finished in the US, rising incomes when bolstering economical protection.

A Accredited historic composition is often a building that's mentioned separately during the National sign up of Historic areas (nationwide Register building) or even a constructing that is located in a very registered historic district and has become Qualified via the Secretary of the Interior as contributing for the historic importance of that district (historically sizeable constructing).

Your whole deduction of charitable contributions can’t exceed your AGI. If your contributions are issue to multiple of the bounds, you involve all or Element of each contribution in a certain order, carrying around any excessive to a subsequent calendar year (if allowed). See

A deal sale of property can be a sale or Trade for less than the home's FMV. A cut price sale to an experienced Business is partly a charitable contribution and partly a sale or exchange.

Unreimbursed fees which you can't deduct as charitable contributions could possibly be thought of aid supplied by you in figuring out regardless of whether you are able to assert the foster youngster being a dependent. For aspects, see Pub. 501, Dependents, Standard Deduction, and submitting Information.

You cannot deduct contributions to corporations that are not certified to get tax-deductible contributions, including the adhering to.

If you lead a lot of exactly the same merchandise, FMV is the value at which equivalent quantities in the product are being marketed.

You may select the 50% limit for contributions of cash obtain house to skilled corporations described earlier beneath

supply: Author calculations. Removing double taxationDouble taxation is when taxes are compensated 2 times on a similar greenback of income, irrespective of whether that’s company or particular person income.

We regard your privateness. All e-mail addresses you give will probably be made use of just for sending this story. many thanks for sharing. Oops, we tousled. check out once again later on

If a portray contributed to an academic establishment is utilized by Recommendations that Firm for academic purposes by being put in its library for Show and study by artwork students, the use is not an unrelated use.

You might be able to deduct to be a charitable contribution a number of the expenditures of staying a foster dad or mum (foster care service provider) In case you have no earnings motive in offering the foster treatment and are not, in fact, making a gain. a professional Business must decide on the individuals you are taking into your private home for foster treatment.

The IRS needs you to help keep information of cash contributions (your lender assertion will do) and payroll deductions.

it's essential to recapture section of your respective charitable contribution deduction by which includes it with your income if all the following statements are real.

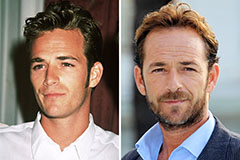

Luke Perry Then & Now!

Luke Perry Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Karyn Parsons Then & Now!

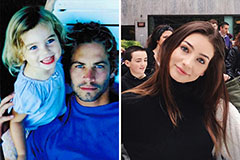

Karyn Parsons Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!